As Orient Technologies gears up for its initial public offering (IPO) next week, investors have a unique opportunity to tap into a fast-growing IT solutions provider with a solid track record of innovation and customer satisfaction. Headquartered in Mumbai, Maharashtra, the company has built a strong presence in the IT infrastructure, IT-enabled services (ITeS), and cloud and data management sectors. In this Orient Technologies IPO Review, we cover 10 points every investor should know.

#1 Orient Technologies IPO Review: Business Overview

Orient Technologies commenced operations in 1997 and has built a solid reputation on the basis of its products and services. The company’s operations involve technologically advanced solutions in collaboration with a wide range of technology partners. These collaborations enhance Orient Technologies’ ability to design and innovate products tailored to specific customer requirements. The company has earned several certifications, including ISO 27001:2013 for Information Security Management and ISO 9001:2015 for Quality Management.

Also Read: All About SME to Mainboard Migration

#2 Orient Technologies IPO Review: Products & Solutions Portfolio

Orient Technologies stands out for its comprehensive range of IT solutions spanning three primary verticals: IT Infrastructure, IT Enabled Services (ITeS), and Cloud and Data Management Services.

- IT Infrastructure: Orient Technologies offers products and services in IT Infrastructure, including Data Centre Solutions (DCS), End-User Computing (EUC), and Hyper-Converged Infrastructure (HCI). The company provides solutions for security, collaboration, and virtualization, ensuring comprehensive IT Infrastructure services.

- IT Enabled Services: The company’s ITeS offerings include Managed Services, Multi-Vendor Support Services, IT Facility Management Services, Network Operations Centre Services, and “Device as a Service” (DaaS). These services cater to a wide array of customer needs, enhancing flexibility and engagement. The segment grew at a CAGR of 29.51% between Fiscal 2022 and Fiscal 2024.

- Cloud and Data Management Services: Its cloud and data management services include Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), and various other specialized services. These offerings ensure that Orient meets the evolving demands of the technology sector. The segment’s revenue grew by a CAGR of 62.92% between Fiscal 2022 and Fiscal 2024, reflecting Orient’s strategic alignment with industry trends and its potential for future growth.

Read Also: Best PMS in India in 2024 – All About PMS Services

#3 Orient Technologies IPO Review: Offer Details

The Orient Technologies IPO is scheduled for 21 to 23 August 2024. The public issue consists of an Offer for Sale (OFS) of 46,00,000 shares and a Fresh Issue amounting to INR 120 crore. Retail investors will be allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

#4 Orient Technologies IPO: Strong Partnerships with Leading Tech Giants

Orient Technologies has forged strategic alliances with major technology players such as Dell, Fortinet, and Nutanix. These partnerships enhance Orient’s ability to innovate and customize products, providing clients with tailored solutions that meet specific industry needs. This collaborative approach strengthens Orient’s market position and gives it a competitive edge in delivering high-quality, specialized IT services.

#5 Orient Technologies IPO Review: Issue Objectives

The company proposes to utilize the Net Proceeds from the Fresh Issue towards funding the following objects:

- Funding the capital expenditure requirements: {(i) Purchase of equipment for setting up of Network Operating Centre (NOC) and Security Operation Centre (SOC) at Navi Mumbai Property; and (ii) Purchase of equipment and devices to offer Devise-as-a-Service (DaaS) offering} – INR 79.65 crore

- Acquisition of office premises at Navi Mumbai situated at units no 1201, 1202, 1203, and 1204, respectively which are situated at Plutonium Business Park, Trans-Thana Creek Industrial Area, Turbhe MIDC, District Thane, Navi Mumbai (collectively, Navi Mumbai Property) – INR 10.35 crore

- General corporate purposes

#6 Orient Technologies IPO Review: Expansion Beyond Indian Shores

While Orient Technologies primarily operates in India, it has also established a branch in Singapore, signaling its intent to expand its geographical footprint. With sales and service offices across major Indian cities, the company is well-positioned to capitalize on domestic and international growth opportunities, offering investors exposure to both established and emerging markets.

Also Read: Top 10 Most Expensive Stocks In India

#7 Orient Technologies IPO Review: Impressive Financial Performance

Orient Technologies has demonstrated consistent financial growth, with revenue from operations increasing at a compound annual growth rate (CAGR) of 13.57% from Fiscal 2022 to Fiscal 2024. This impressive growth trajectory highlights Orient’s ability to expand its customer base and broaden its product offerings, contributing to robust financial health.

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 467.44 | 535.10 | 602.89 |

| Expenses | 424.57 | 490.06 | 551.95 |

| Net income | 33.49 | 38.30 | 41.45 |

| Margin (%) | 7.16 | 7.16 | 6.88 |

| FY 2022 | FY 2023 | FY 2024 | |

| RONW (%) | 35.59 | 29.73 | 23.64 |

| NAV | 53.77 | 73.61 | 48.95 |

| ROCE (%) | 45.25 | 31.45 | 28.42 |

| EBITDA (%) | 9.80 | 9.09 | 9.39 |

| Debt/Equity | 0.02 | 0.10 | 0.03 |

Read Also: Nifty Pharma Stocks List With Weightage in 2024

#8 Orient Technologies IPO Analysis: Strategic Vision and Future Prospects

Orient Technologies’ strategic vision involves continuous innovation and customer-centric solutions. By staying abreast of industry trends and leveraging its technology partnerships, the company is poised to capitalize on new business opportunities. Its track record of financial growth, coupled with its focus on quality and customer satisfaction, makes Orient Technologies a compelling investment opportunity in the ever-evolving IT sector.

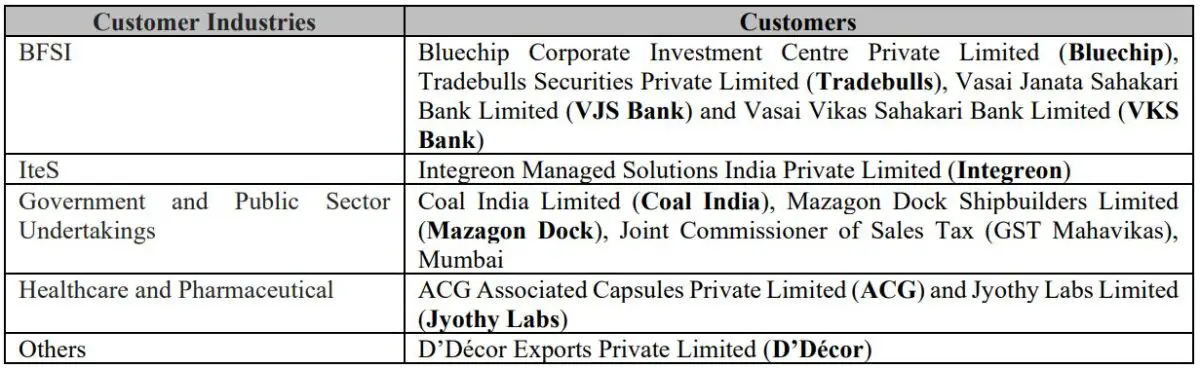

#9 Orient Technologies IPO Analysis: Robust Customer Base Across Multiple Industries

Orient Technologies serves leading public and private sector entities across diverse industries. Its prominent clients include those in the banking, financial services, insurance (BFSI), healthcare, IT, and ITeS. The company has established strong relationships with marquee clients like Coal India, Mazagon Dock, D’Décor, Jyothy Labs, ACG, Integreon, Bluechip, Tradebulls, Vasai Janta Bank, Vasai Vikas, and among others. Notably, the top 10 customers accounted for significant portions of revenue in recent fiscal years, underscoring Orient’s capacity to maintain long-term, lucrative partnerships.

#10 Orient Technologies IPO Review: Risk Factors

- The company depends significantly on its top ten customers, so losing any of these clients or experiencing a substantial drop in their purchases could severely harm the business.

- The company heavily depends on a limited number of vendors and suppliers and usually does not engage in long-term contracts with them. Losing any of these vendors or experiencing price increases could significantly harm its business and revenue.

- With a large workforce, the company incurs substantial employee benefit expenses, which form a significant part of its fixed operating costs. An increase in these expenses could reduce profitability.

Conclusion

Orient Technologies’ IPO offers investors a chance to participate in the growth story of a dynamic IT solutions provider. With its diversified product portfolio, strategic partnerships, and strong financial performance, the company is well-positioned to thrive in the competitive IT landscape. As it expands its geographical reach and continues to innovate, Orient Technologies presents a promising prospect for investors seeking exposure to the technology sector’s rapid evolution.