The Nifty MNC Index comprises 30 listed companies on the National Stock Exchange (NSE) in which the foreign promoter shareholding is over 50%. The Nifty MNC Index is computed using the free float market capitalization method, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to a particular base market capitalization value.

In this article, we have compiled a Nifty MNC stocks list with weightage which is periodically updated. The Nifty MNC Index can be used for a variety of purposes such as benchmarking fund portfolios, and launching index funds, ETFs, and structured products.

What is the Nifty MNC Full Form and Index?

The Nifty MNC Index stands for Nifty Multi-National Companies Index. The NIFTY MNC is a thematic index on the NSE that tracks the real-time performance of Indian multi-national companies.

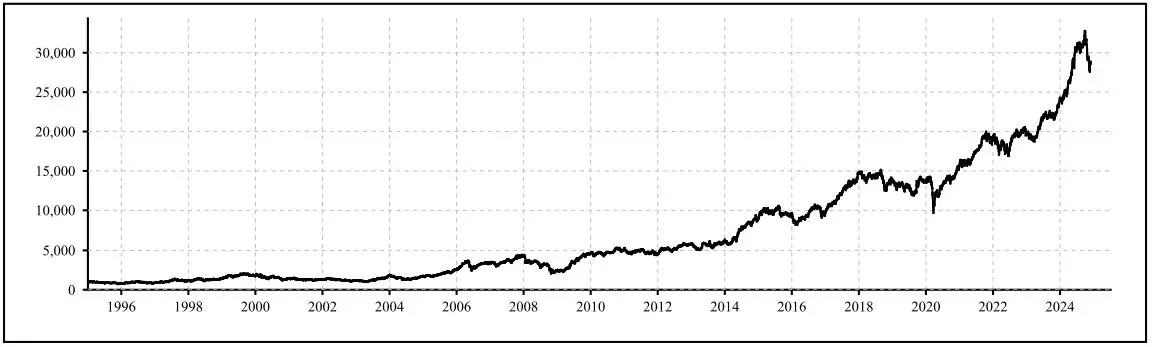

The index reflects the performance of companies with foreign promoter shareholding exceeding 50%. Initially comprising up to 15 companies, it had a base date of January 2, 1995, and a base value of 1,000 points. This number was increased from 15 to 30 on 28 September 2018, with each company’s weight capped at 10%. During rebalancing or changes in constituents and investable weight factors (IWFs), the weight remains capped at 10%, though it may exceed this limit between rebalancing periods.

Read Also: Nifty Pharma Stocks List With Weightage in 2024

Nifty MNC Companies Re-Balancing

Constituent companies in the Nifty MNC Index are re-balanced on a semi-annual basis. The cut-off date is 31 January and 31 July of each year, i.e. for semi-annual review of indices, average data for 6 months ending the cut-off date is considered.

A prior notice of at least four weeks is given to the market from the date of the change. As a result, changes made on 31 January will be effective from 31 March.

Index Governance

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE Indices Limited, the Index Advisory Committee (Equity), and the Index Maintenance Sub-Committee.

Key Features of the Nifty MNC Index

- Composition: The Nifty MNC Index comprises 30 listed companies, spanning various sectors such as FMCG, Capital Goods, and Healthcare.

- Calculation Method: The index is calculated using the free float market capitalization method, which reflects the total market value of all the stocks in the index relative to a base market capitalization value. This allows it to be used for benchmarking fund portfolios and launching investment products like index funds and ETFs.

- Launch Date: The index was launched on January 2, 1995, with a base value set at 1000.

Read Also: Nifty FMCG Stocks List With Weightage in 2024

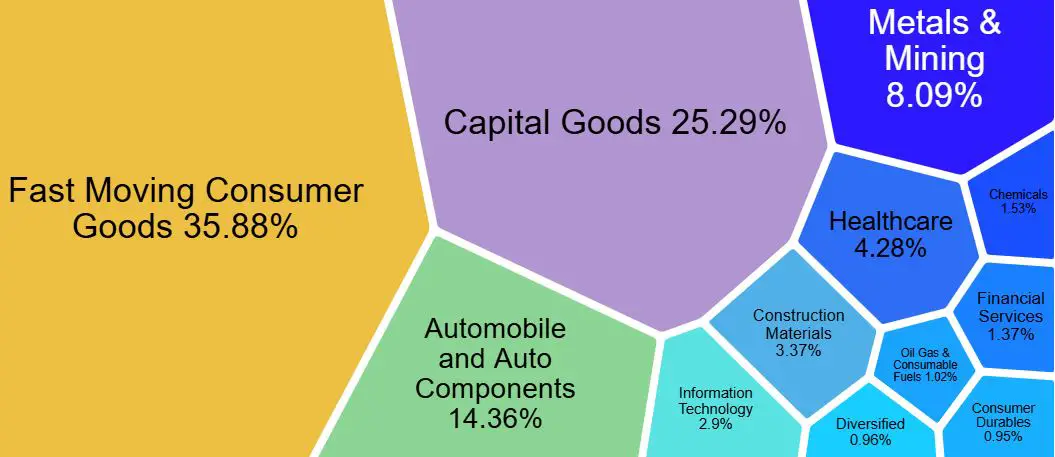

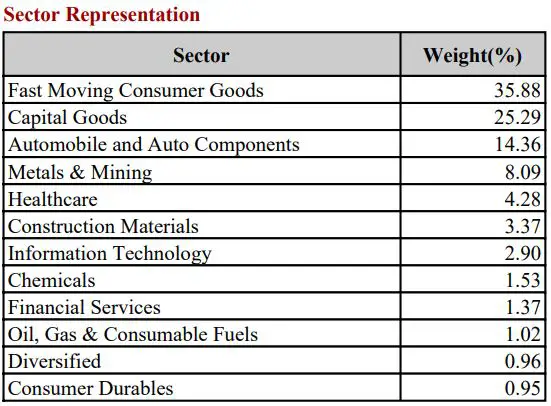

Nifty MNC Sector Weightage

The NIFTY MNC Index gives a weightage of 35.88% to FMCG, 25.29% to Capital Goods, 14.36% to Automobile and Auto Components, 8.09% to Metals & Mining, 4.28% to Healthcare, 3.27% to Construction Materials, and 2.90% Information Technology. The NIFTY MNC index is a free-float market capitalization index. It is important to highlight that the Nifty MNC weightage of sectors keeps changing according to the performance of constituent stocks.

Nifty MNC Sectoral Distribution

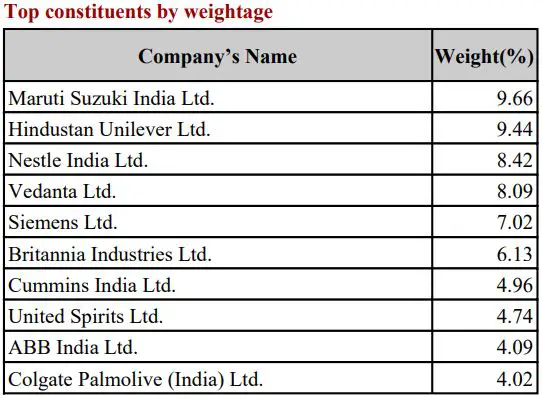

Top 10 Nifty MNC Companies by Weightage in 2024

The Nifty MNC Index list of top 10 stocks consisted of the following:

Nifty MNC Stocks List With Weightage

| COMPANY NAME | SECTOR | WEIGHTAGE (%) |

| Maruti Suzuki India Ltd. | Automobile and Auto Components | 9.66 |

| Hindustan Unilever Ltd. | FMCG | 9.44 |

| Nestle India Ltd. | FMCG | 8.42 |

| Vedanta Ltd. | Metals & Mining | 8.09 |

| Siemens Ltd. | Capital Goods | 7.02 |

| Britannia Industries Ltd. | FMCG | 6.13 |

| Cummins India Ltd. | Capital Goods | 4.96 |

| United Spirits Ltd. | FMCG | 4.74 |

| ABB India Ltd. | Capital Goods | 4.09 |

| Colgate Palmolive (India) | FMCG | 4.02 |

| Ashok Leyland Ltd. | Capital Goods | 3.49 |

| Ambuja Cements Ltd. | Construction Materials | 3.37 |

| Bosch Ltd. | Automobile and Auto Components | 3.19 |

| Oracle Financial Services Software | Information Technology | 2.90 |

| Procter & Gamble Hygiene & Health Care | FMCG | 1.58 |

| United Breweries Ltd. | FMCG | 1.54 |

| Linde India Ltd. | Chemicals | 1.53 |

| Abbott India Ltd. | Healthcare | 1.52 |

| Schaeffler India Ltd. | Automobile and Auto Components | 1.52 |

| Gland Pharma Ltd. | Healthcare | 1.45 |

| CRISIL Ltd. | Financial Services | 1.37 |

| J.B. Chemicals & Pharmaceuticals Ltd. | Healthcare | 1.30 |

| Timken India Ltd. | Capital Goods | 1.28 |

| Escorts Kubota Ltd. | Capital Goods | 1.25 |

| SKF India Ltd. | Capital Goods | 1.22 |

| Castrol India Ltd. | Oil Gas & Consumable Fuels | 1.02 |

| Grindwell Norton Ltd. | Capital Goods | 1.02 |

| 3M India Ltd. | Diversified | 0.96 |

| Bata India Ltd. | Consumer Durables | 0.95 |

| Honeywell Automation India Ltd. | Capital Goods | 0.94 |

Nifty MNC Index Vs Other Sectoral Indices

Read Also: Nifty IT Stocks List With Weightage in 2024

Nifty MNC Index List: Eligibility Criteria

The eligibility criteria for the selection of constituent stocks in the Nifty MNC Index are designed to ensure that only high-quality multinational companies are included. These criteria are as follows:

- Nifty 500 Inclusion: Companies must be part of the Nifty 500 at the time of review. If there are fewer than 10 eligible stocks from a particular sector within the Nifty 500, additional stocks may be selected from the top 800 ranked by average daily turnover and market capitalization over the previous six months.

- Foreign Promoter Shareholding: Eligible companies must have foreign promoter shareholding exceeding 50%, ensuring that these firms are significantly influenced by foreign ownership.

- Trading Frequency: The company’s trading frequency should be at least 90% over the last six months, indicating consistent market activity and liquidity.

- Listing History: A minimum listing history of one month is required as of the cutoff date, allowing for a brief evaluation period for newly listed companies.

- Free-Float Market Capitalization: The final selection of stocks is based on their free-float market capitalization, ensuring that only those companies with substantial market value are included in the index.

These criteria help maintain the integrity and quality of the Nifty MNC Index, reflecting the performance of leading multinational corporations operating in India.

Nifty MNC Index List: Eligible Basic Industries

Companies from the following industries are eligible to be considered for inclusion in the Nifty MNC Index List:

- Capital Goods

- FMCG

- Automobile and Auto Components

- Oil Gas & Consumable Fuels

- Healthcare

- Construction Materials

- Information Technology

- Chemicals

- Diversified

- Financial Services

- Metals & Mining

- Consumer Durables

Read Also: Nifty Auto Stocks List With Weightage in 2024

Nifty MNC Index Weightage FAQs

How many stocks are there in the Nifty MNC Index?

Nifty MNC Index has 30 stocks like Maruti Suzuki India, Hindustan Unilever, Nestle India, Vedanta Ltd, and Siemens Ltd.

How frequently is the Nifty MNC Index rebalanced?

The Nifty MNC Index is rebalanced every 6 months with the cut-off dates being 31 January and 31 July each year.

Which company tops in Nifty MNC weightage stocks?

On 29 November 2024, Maruti Suzuki India had the maximum weightage of 9.66%, followed by Hindustan Unilever at 9.44%.

What is Nifty MNC performance in the last 12 months?

As of 29 November 2024, the index had returned 28.47% over the last 1 year including dividends.

Can we trade directly in the Nifty MNC index?

No, direct trading in the Nifty MNC Index is not possible. However, investors can gain exposure through index-based exchange-traded funds (ETFs) such as Kotak Nifty MNC ETF.