Next week promises to be an exciting time for investors with as many as nine companies going public with initial public offerings (IPOs). With industries spanning from technology to real estate and agribusiness, investors will have plenty of options to choose from as they navigate the dynamic market landscape. Here’s an overview of the nine companies launching their IPOs and what you should know about them.

1. Indegene – First Among the Upcoming IPOs Next Week

Indegene will be the first one to hit the primary market among upcoming IPOs next week. With a substantial issue size of INR 1,841.76 crore, it stands as the fifth largest offer of 2024 thus far. The public issue consists of an Offer for Sale (OFS) of 23,932,732 shares and a Fresh Issue amounting to INR 760 crores. The IPO has been priced at INR 430 – 452 per share.

Indegene is a leading provider of digital-led commercialization services to the life sciences industry, catering to biopharma, emerging biotech, and medical device companies. The company has relationships with each of the 20 largest biopharmaceutical companies globally by revenue. As of 31 December 2023, Indegene had a total of 65 active clients. The company has developed a suite of proprietary tools and platforms, including applications that automate and create AI-based efficiencies using AI, ML, NLP, and advanced analytics capabilities.

2. TBO Tek – Travel Player to Raise INR 1,550 crore

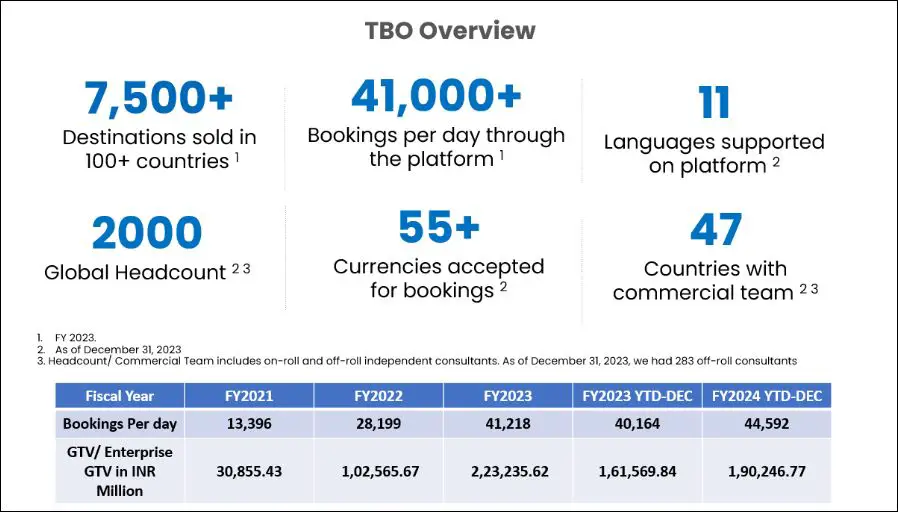

Hyderabad-based TBO Tek is set to launch its IPO on 8 May 2024. This IPO encompasses a combination of fresh issue and an Offer For Sale (OFS) by private equity firms TBO Korea, and Augusta TBO.

TBO Tek is a major global travel distribution platform that connects more than 159,000 buyers in over 100 countries with over one million suppliers as of 31 December 2023. The platform consists of two portals: TBO Holidays, which serves as a global travel distribution platform, and Travel Boutique Online, which caters specifically to travel buyers in India.

3. Aadhar Housing Finance: Offer Size of INR 3,000 crore

Aadhar Housing Finance is a retail-focused affordable housing finance company (HFC), serving economically weaker and low-to-middle-income customers, who require small-ticket mortgage loans. It is the largest affordable HFC in India in terms of AUM. Aadhar has an extensive branch network of over 470 locations across 20 Indian states, allowing it to reach a wide customer base.

The mainboard IPO, open for subscription from 8 to 10 May 2024, features a price band of INR 300 -315 per share and a lot size of 47 shares. The company aims to raise INR 1,000 crore by issuing fresh shares while existing shareholders plan to sell shares worth up to INR 2,000 crore, taking the IPO size to INR 3,000 crore.

4. Winsol Engineers

Based in Jamnagar, Winsol Engineers is an integrated engineering, procurement, construction, and commissioning company that offers Balance of Plant (BoP) solutions for wind and solar power generation companies. The company’s core services for BoP Solutions include foundation work, substation civil and electrical work, right-of-way services, cabling to substations and grids, and miscellaneous work.

Winsol IPO opens for subscription on May 6 and closes on May 9, 2024. The company aims to raise around INR 22.12 – 23.36 crore, with the price set at INR 71 – 75 per share.

A consistent rise in topline and bottomline, and a pre-IPO PE ratio of less than 12 are the highlights attracting investors.

5. Refractory Shapes

Finally, Refractory Shapes has announced plans to launch its IPO for subscription from May 6 to May 9, 2024. With an issue price of INR 27 – 31 per share, the total issue size is INR 16.20 – 18.60 crore, comprising 6,000,000 equity shares with a face value of INR 10 each. The IPO is expected to list on the NSE SME on May 14, 2024. The company specializes in manufacturing various products, including bricks, castables, high alumina catalysts, and ceramic balls. This includes pre-cast and pre-fired blocks (PCPF), burner blocks, uniquely shaped refractory bricks, dense and insulating castables, and mortars.

6. Finelistings Technologies

Finelistings Technologies is involved in a diverse range of businesses, including (a) retailing pre-owned luxury cars; and (b) software development services.

Finelistings Technologies IPO is intriguing for investors due to its fresh issue of 11,00,000 shares valued at INR 13.53 crores. The company’s intention to allocate these funds towards specific objectives adds to the appeal.

7. Silkflex Polymers

Silkflex Polymers is a manufacturer of specialty chemicals, which are used in a wide range of industries such as textiles, pharmaceuticals, and personal care. The company has demonstrated strong financial performance in recent years, with increasing revenues and profitability.

Silkflex is set to launch its IPO in the SME segment. The public offer opens for subscription on May 7 and closes on May 10, 2024. The company aims to raise around INR 18.11 crore, with the price at INR 52 per share.

8. TGIF Agribusiness

TGIF Agribusiness IPO is particularly interesting for investors due to the company’s strong financial performance and growth potential in the agribusiness sector. The company focuses on pomegranate farming, which accounts for over 95% of its operational revenue. Additionally, the company is involved in farming and cultivating dragon fruits and Sagwan trees. It also grows and harvests a variety of seasonal vegetables and fruits, including lemons, watermelons, and chilies.

The SME IPO is open for subscription from May 8 to May 10, 2024. The company aims to raise around INR 6.39 crore, with the price per share set at INR 93.

9. Energy Mission Machineries

The Energy Mission Machineries (India) IPO is scheduled to open on May 9 to close on May 13, 2024. The IPO price band is set at INR 131 – 138 per share, with a market lot of 1000 shares. Energy Mission Machineries has a track record of supplying CNC and NC machines globally, having delivered 1,487 machines to over 1,050 customers in various countries like the USA, Switzerland, and Russia between April 2023 and August 2023. This IPO presents an opportunity for investors to engage with a company that has a strong international presence and a focus on manufacturing sheet metal processing machinery.

In addition to the above-mentioned upcoming IPOs, there will be several SEBI approvals, listings, and allotment status updates of the recently concluded offers. Investors keen on these IPOs should stay informed about the latest updates including live subscription by checking IPO Central regularly and subscribing to our notifications.