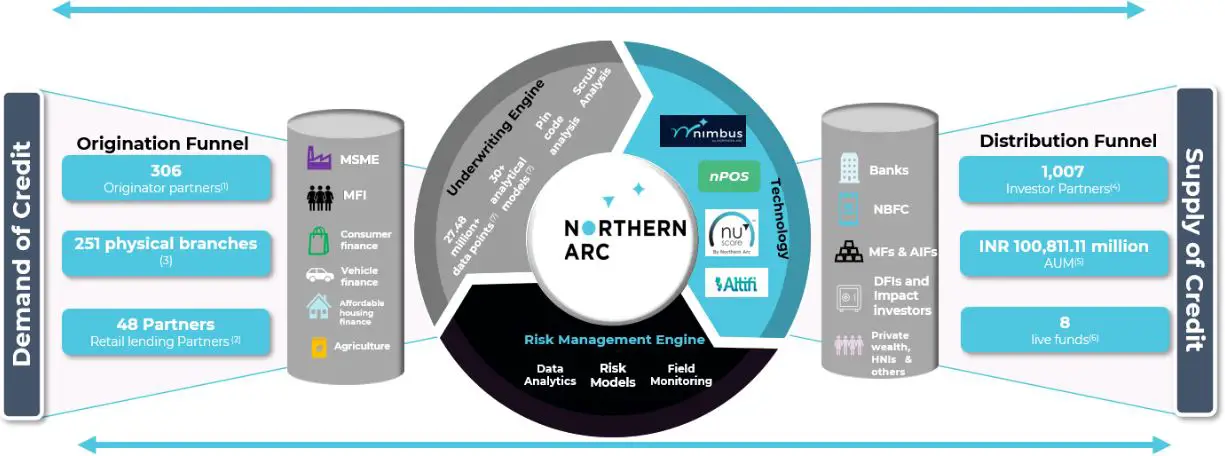

Northern Arc Capital IPO Description – Northern Arc Capital is a diversified financial services platform established to meet the varied retail credit needs of under-served households and businesses across India. Since it entered into the financial inclusion space in 2009, the company has facilitated financing of over INR 1.73 trillion, impacting more than 101.82 million lives, created an ecosystem of 328 Originator Partners, 50 Retail Lending Partners, and 1,158 Investor Partners across India as of 31 March 2024. As of Fiscal Year 2024, the company had one of the lowest gross non-performing assets (GNPA) at 0.45% and net non-performing assets (NNPA) at 0.08%.

The company stands out as one of India’s leading diversified non-banking financial companies (NBFCs) in terms of Assets under Management (AUM) as of 31 March 2024. Northern Arc Capital has honed its expertise in facilitating credit across targeted sectors in India, including micro, small, and medium enterprises (MSMEs) financing, microfinance (MFI), consumer finance, vehicle finance, affordable housing finance, and agricultural finance. As of 31 March 2024, the company had 2,695 permanent employees.

Northern Arc Capital’s quantitative analysis is grounded in over 35.17 million data points, comprising (a) loan pools the company has assessed and invested in on behalf of Originator Partners from Investor Partners through securitizations and direct assignments as of 31 March 2024, and (b) more than 18.58 million Direct to Customers Lending loans it has disbursed as of the same date.

Promoters of Northern Arc Capital – Does not have an Identifiable Promoter

Northern Arc Capital IPO Details

| Northern Arc Capital IPO Dates | 16 – 19 September 2024 |

| Northern Arc Capital Issue Price | Coming soon |

| Fresh issue | INR 500 crore |

| Offer For Sale | 1,05,32,320 shares |

| Total IPO size | Coming soon |

| Minimum bid (lot size) | Coming soon |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Northern Arc Capital Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 909.54 | 1,304.97 | 1,890.08 |

| Expenses | 668.16 | 988.10 | 1,484.83 |

| Net income | 181.94 | 242.21 | 317.69 |

| Margin (%) | 20.00 | 18.56 | 16.81 |

Northern Arc Capital Offer News

Northern Arc Capital Valuations & Margins

| FY 2022 | FY 2023 | FY 2024 (Pre Issue) | FY 2024 (Post-Issue)* | |

| EPS | 13.09 | 17.38 | 23.40 | 23.40 |

| PE Ratio | – | – | – | – |

| FY 2022 | FY 2023 | FY 2024 | |

| RONW (%) | 9.92 | 11.76 | 13.32 |

| NAV | 133.54 | 150.01 | 177.06 |

| EBITDA (%) | 73.51 | 68.26 | 61.56 |

| Debt/Equity | 3.27 | 3.40 | 3.90 |

Northern Arc Capital IPO GMP Today (Daily Trend)

Northern Arc Capital IPO Objectives

- Utilize the Net Proceeds towards augmenting the company’s capital base to meet its future capital requirements

- The company expects to receive the benefits of listing the Equity Shares on the Stock Exchanges

- Enhancement of the company’s brand name and creation of a public market for their Equity Shares in India

- The main objects in the Memorandum of Association enable the company to undertake its existing activities and the activities for which funds are being raised through the Fresh Issue.

Northern Arc Capital IPO Subscription – Live Updates

Coming soon

Northern Arc Capital – Comparison With Listed Peers

Northern Arc Capital IPO Allotment Status

Northern Arc Capital IPO allotment status will be available on the KFin Tech website. Click on this link to get allotment status.

Northern Arc Capital IPO Dates & Listing Performance

| IPO Opening Date | 16 September 2024 |

| IPO Closing Date | 19 September 2024 |

| Finalization of Basis of Allotment | 20 September 2024 |

| Initiation of refunds | 23 September 2024 |

| Transfer of shares to demat accounts | 23 September 2024 |

| Northern Arc Capital IPO Listing Date | 24 September 2024 |

| Opening Price on NSE | Coming soon |

| Closing Price on NSE | Coming soon |

Northern Arc Capital IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

BP Wealth –

Capital Market –

Canara Bank Securities –

Choice Broking –

Dalal & Broacha –

Elite Wealth –

GCL Broking –

Geojit –

GEPL Capital –

Hem Securities –

ICICIdirect –

Investmentz –

Jainam Broking –

DR Choksey –

LKP Research –

Marwadi Financial –

Mehta Equities –

Motilal Oswal –

Nirmal Bang –

Reliance Securities –

Religare Broking –

Samco Securities –

SBI Securities –

SMC Global –

Swastika Investmart –

Ventura Securities –

Northern Arc Capital Offer Lead Manager

AXIS CAPITAL LIMITED

1st Floor, Axis House C-2 Wadia International Center

Pandurang Budhkar Marg, Worli Mumbai – 400 025 Maharashtra

Phone: +91 22 4325 2183

Email: [email protected]

Website: www.axiscapital.co.in

Northern Arc Capital Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower – B, Plot 31 & 32, Gachibowli,

Financial District, Nanakramguda, Serilingampally,

Hyderabad – 500 032, Telangana

Tel: +91 40 6716 2222

E-mail: [email protected]

Website: www.kfintech.com

NORTHERN ARC CAPITAL LIMITED

No. 1, Kanagam Village, 10th Floor, IITM Research Park,

Taramani, Chennai 600 113, Tamil Nadu

Phone: +91 44 6668 7000

Email: [email protected]

Website: www.northernarc.com

Northern Arc Capital IPO FAQs

How many shares in Northern Arc CapitalIPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply for a Northern Arc Capital Public Offer?

The best way to apply for Northern Arc Capital’s public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Northern Arc Capital IPO GMP today?

Northern Arc Capital IPO GMP today is INR NA per share.

What is Northern Arc Capital kostak rate today?

Northern Arc Capital kostak rate today is INR NA per application.

What is Northern Arc Capital Subject to Sauda rate today?

Northern Arc Capital Subject to Sauda rate today is INR NA per application.