The renewable energy sector in India is rapidly evolving, with several key players vying for leadership in solar energy. Among them, NTPC Green Energy (NGEL) is a subsidiary of NTPC Limited, India’s largest power producer. This article provides a comparative analysis of NTPC Green Energy competitors: Adani Green Energy, ReNew Power, Greenko, ACME Solar Holding, JSW Neo Energy, and Tata Power Renewable Energy (REL). Each company’s operational capacity, recent investments, and strategic initiatives will be analyzed to understand its positioning in the solar energy market.

Overview of NTPC Green Energy Competitors in Solar Energy Sector

#1 NTPC Green Energy

NTPC Green Energy is a pivotal player in India’s renewable energy landscape. With an operational capacity of 3.34 GW from solar and 0.21 GW from wind—NGEL is on a robust growth trajectory. The company has a significant pipeline of 10.57 GW of renewable projects, with 8.13 GW under construction as of 30 September 2024. The company aims to expand its total renewable energy capacity to 60 GW by FY 2032.

The NTPC Green Energy IPO is scheduled to launch on November 19, 2024, with a target to raise INR 10,000 crore through a fresh issue of shares priced between INR 102 and INR 108 each. The offering will close on November 22, while the anchor book for institutional investors will open on November 18. The company has earmarked INR 200 crore worth of shares for its employees, who will receive a discount of INR 5 per share on the final issue price. In addition, there is a reservation for shareholders of NTPC Ltd.

This IPO capital will be utilized to repay existing borrowings and fund strategic initiatives, including potential acquisitions and expansions into green hydrogen and ammonia projects.

Read Also: Top Green Hydrogen Stocks in India

#2 Adani Green Energy

Adani Green Energy (AGEL) has emerged as one of the largest renewable energy companies in India, boasting an operational capacity of 7.4 GW from solar and 1.7 GW from wind as of 30 September 2024. The company has ambitious plans to invest INR 2 trillion by 2030 to expand its capacity to 50 GW. AGEL’s recent partnerships include a collaboration with TotalEnergies to develop a 1.15 GW renewable energy portfolio. In the first half of fiscal year 2025, AGEL’s energy sales grew by 20%, showcasing its strong market presence and operational efficiency.

#3 ReNew Power

ReNew Power is another major contender in the Indian solar market with a diversified portfolio that includes wind and solar projects across various states. As of 30 September 2024, ReNew Power has an operational capacity exceeding 8.3 GW and continues to expand aggressively. In recent developments, ReNew Power secured significant funding through various investment rounds aimed at enhancing its renewable energy capabilities. The company has also entered into partnerships for the development of solar power plants aimed at supporting sustainable initiatives across sectors like education and health care.

The company announced plans to invest heavily in battery storage technologies to complement its renewable energy offerings. With revenues of around INR 8,194.8 crore, ReNew remains a strong competitor in the market.

Read Also: Tata Group Companies: Comprehensive List of All Companies Under Tata Group

#4 Greenko Energy Holdings

Greenko is recognized for its innovative approach to renewable energy generation and storage solutions. The company has established itself as a leader in integrated renewable energy solutions with an operational capacity of around 5.37 GW as of 30 September 2024.

Greenko’s strategy focuses on hybrid projects that combine solar and wind power with storage capabilities to ensure reliability and efficiency. Recent investments have been directed towards expanding their storage capabilities, which are critical for balancing supply and demand in renewable energy systems.

#5 ACME Solar Holding

ACME Solar Holding is one of India’s leading solar power producers with an operational capacity exceeding 1.34 GW as of 30 September 2024. The company has made significant strides in the solar sector through innovative project financing and strategic partnerships.

ACME recently secured funding for new solar projects aimed at increasing its capacity significantly over the next few years. The company has contracted projects under construction totaling 1.65 GW, including 1.50 GW of solar power projects and 0.15 GW of wind power projects. Their focus on technology-driven solutions has positioned them well within the competitive landscape of solar energy providers.

ACME Solar also has an awarded project pipeline under construction amounting to 2.38 GW, comprising 0.30 GW of solar power projects, 0.83 GW of hybrid power projects, and 1.25 GW of FDRE power projects, as of 31 March 2024.

#6 JSW Neo Energy

JSW Neo Energy is part of the JSW Group and focuses on developing renewable energy projects across India. With an operational capacity of 0.7 GW from solar power and 2.0 GW from wind as of 30 September 2024. JSW Neo is rapidly expanding its footprint in the renewable sector. The company has a significant pipeline of 6.5 GW of renewable projects.

The company has announced plans for significant investments aimed at doubling its capacity within the next few years. JSW Neo’s strategy includes leveraging technological advancements to enhance efficiency and reduce costs associated with solar power generation.

Read Also: Upcoming Reliance Group IPOs: Two IPOs Lined-Up

#7 Tata Power Renewable Energy (REL)

TATA Power is one of the oldest players in India’s power sector and has made significant investments in renewable energy over the past decade. As of 30 September 2024, the company currently operates over 4.7 GW of renewable energy capacity, primarily from solar (3.7 GW) installations.

Tata Power has been actively investing in expanding its solar portfolio through acquisitions and new project developments. Recent initiatives include partnerships aimed at enhancing grid connectivity for their solar projects, ensuring reliability and efficiency in power delivery.

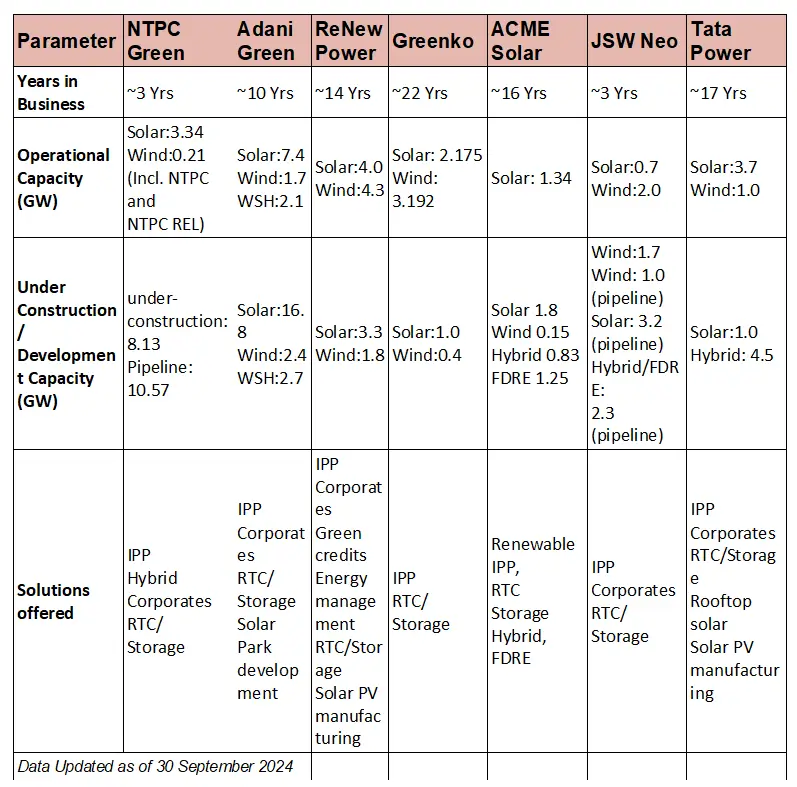

The following table summarises the competitive analysis of NTPC Green Energy and its competitors in the renewable energy sector

Conclusion

In summary, NTPC Green Energy is carving out a significant niche within India’s burgeoning renewable energy sector through strategic investments and an aggressive expansion plan. While it faces stiff competition from established players like Adani Green Energy and ReNew Power, its focus on large-scale project execution and diversification into emerging technologies such as green hydrogen positions it well for future growth.