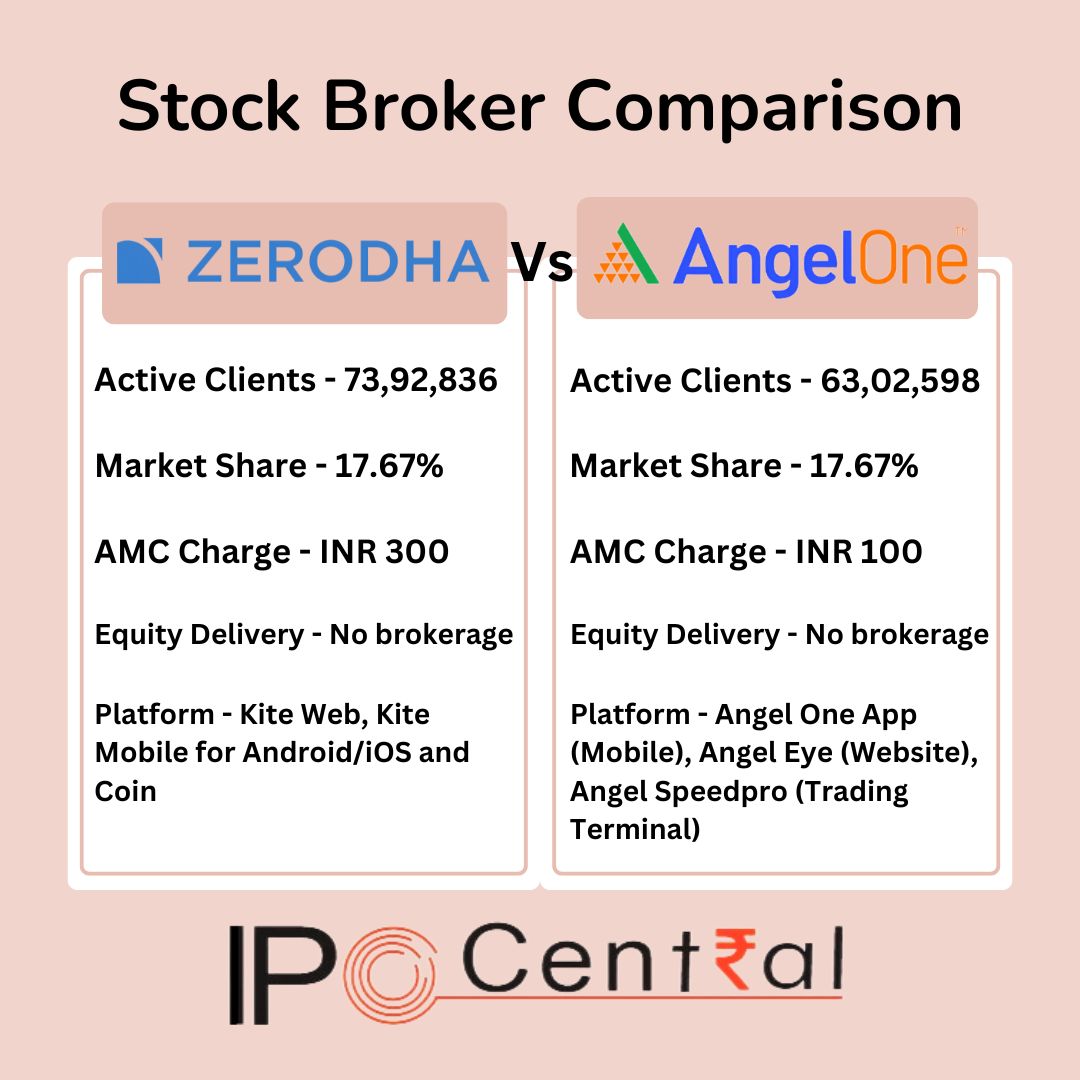

Zerodha and Angel One are among the top stock brokers in India. Both brokers are registered with SEBI and offer investments in different market segments like Equity, F&O, Currency, and Commodities. However, they provide state-of-the-art trading platforms and charge low and flat brokerage charges. In this article, we are going to do a Zerodha Vs Angel One comparison to find out their pros and cons.

The brokerage of Zerodha is INR 20 or 0.03% whichever is lower per trade while the brokerage of Angel One is INR 20 per order or 0.03% whichever is lower per trade. The number of active clients for Zerodha is 73,92,836 whereas the number of active clients for Angel One stood at 63,02,598 as of April 2024. Zerodha is serving more customers compared to Angel One.

Company Background

Zerodha was founded in 2010 in Bangalore by Nithin Kamath and Nikhil Kamath. It offers trading in NSE, BSE, and MCX exchanges. The company has over 120 partner offices and branches across India.

Angel One, is one of the oldest and most established stockbroking firms in India. It was founded in 1987 by Dinesh Thakkar and is headquartered in Mumbai, Maharashtra. The company started as a sub-broker to serve investors in the Mumbai region but rapidly expanded its operations to become a full-service retail and institutional brokerage.

Also Read: All About Unpaid Dividend and How to Claim It.

Zerodha Vs Angel One Charges

- Zerodha Vs Angel One – Account Opening Charges and AMC

| Account opening and Demat charges | Zerodha | Angel One |

| Equity Trading Account Opening Charges | Online – INR 200 Offline – INR 500 | Zero |

| Commodity Account Opening Charges | Online – INR 100 Offline – INR 500 | Zero |

| Trading Account AMC Charges | Zero | Zero |

| Demat Account Opening Charges | Zero | Zero |

| Demat Account AMC Charges | INR 300 (Above – INR 2,00,000) | INR 100 + GST (Between INR 50,000 to 2,00,000) |

Read Also: State-wise IPO in India

- Zerodha Vs Angel One Brokerage Charges

| Particulars | Zerodha | Angel One |

| Equity Delivery | No brokerage | Zero |

| Equity Intraday | INR 20 per order or 0.03%, whichever is lower | INR 0 brokerage up to INR 500 for first 30 days* Then, lower of INR 20 or 0.03% per executed order |

| Equity Futures | INR 20 per order or 0.03%, whichever is lower | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Equity Options | INR 20 per executed order | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Currency Futures | INR 20 per order or 0.03%, whichever is lower | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Currency Options | INR 20 per executed order | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Commodity Futures | INR 20 per order or 0.03%, whichever is lower | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Commodity Options | INR 20 per executed order | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Call & Trade Charge | INR 50 per executed order | INR 20 per order |

| Minimum Brokerage | 0.03% in Intraday and F&O trades | 0.03% |

| P&L/CMR Charges | INR 20 + INR 100 (courier charge) + 18% GST for subsequent requests | NIL |

Also Read: Zerodha Vs Upstox – Detailed Broker Comparison

- Zerodha Vs Angel One – Transaction Charges

| Particulars | Zerodha | Angel One |

| Equity Delivery | NSE: 0.00322%| BSE: 0.00375% (Both Buy & Sell) (Both Buy and Sell) | NSE: 0.00322% (Both Buy & Sell) |

| Equity Intraday | NSE: 0.00322%| BSE: 0.00375% (Both Buy & Sell) | NSE: 0.00322% (Both Buy & Sell) |

| Equity Futures | NSE: 0.00188%%| BSE: Zero | NSE: 0.00188% (Both Buy & Sell) |

| Equity Options | NSE: 0.0495%| BSE: 0.0495% (on premium) | NSE: 0.0495% | BSE: 0.00495% (on premium) |

| Currency Futures | NSE: 0.0009%| BSE: 0.0009% | NSE: 0.0009% | BSE:0.00022% |

| Currency Options | NSE: 0.035%| BSE: 0.001% | NSE: 0.035% | BSE: 0.001% (on premium) |

| Commodity Futures | Group A – 0.0026% | MCX: 0.0013% | NCDEX: 0.002% |

| Commodity Options | 0.05% | 0.05% (On Premium Value) |

- Zerodha Vs Angel One – Other Statutory Charges

| Particulars | Zerodha | Angel One |

| STT/CTT Equity Delivery | 0.1% (Both Buy & Sell) | 0.1% (Both Buy and Sell) |

| STT/CTT Equity Intraday | 0.025% on the sell side | 0.025% on the Sell Side |

| STT/CTT Equity Futures | 0.0125% on Sell Side | NSE: 0.0125% | BSE:0.0125% on the Sell Side |

| STT/CTT Equity Options | 0.0625% on Sell Side (on Premium) | NSE: 0.0625% | BSE:0.0625% on the Sell Side |

| STT/CTT Currency Futures & Options | No STT | Zero |

| STT/CTT Commodity Futures | 0.01% on sell side (Non-Agri) | 0.01% Only on Non-Agri on the Sell Side |

| STT/CTT Commodity Options | 0.05% on sell side | 0.05% on the Sell side |

| SEBI Turnover Charges | INR 10/crore | INR 10/crore |

| GST | 18% | 18% |

| Stamp Equity Delivery | 0.015% or INR 1500/crore on buy-side | 0.015% or INR 1500/crore on buy-side |

| Stamp Equity Intraday | 0.003% or INR 300/crore on buy-side | 0.003% or INR 300/crore on buy-side |

| Stamp Equity Futures | 0.002% or INR 200/crore on buy-side | 0.002% or INR 200/crore on buy-side |

| Stamp Equity Options | 0.003% or INR 300/crore on buy-side | 0.003% or INR 300/crore on buy-side |

| Stamp Currency Futures | 0.0001% or INR 10/crore on buy-side | 0.0001% or INR 10/crore on buy-side |

| Stamp Currency Options | 0.0001% or INR 10/crore on buy-side | 0.003% or INR 30/crore on buy-side |

| Stamp Commodity Futures | 0.002% or INR 200/crore on buy-side | 0.002% or INR 200/crore on buy-side |

| Stamp Commodity Options | 0.003% or INR 300/crore on buy-side | 0.003% or INR 300/crore on buy-side |

| DP (Depository participant) Charges | INR 13 per scrip | INR 20 + GST per Debit Transaction INR 50 + GST per Debit Transaction for BSDA Clients |

| Pledging Charges | INR 30 per scrip | INR 20 per ISIN l INR 50 per ISIN for BSDA Clients |

| Auto Square off Charges | INR 50 per executed order | INR 20 per Order |

| API Subscription Charges | INR 2,000 per app each month | Zero |

Also Read: Top Stock Brokers In India

- Angel One Vs Zerodha – Feature Comparison

| Feature | Zerodha | Angel One |

| 3 in 1 Account | No | No |

| Algo Trading | Yes | Yes |

| Charting | Yes | Yes |

| Trading Platform | Kite Web Kite Mobile for Android/iOS and Coin | Angel One App (Mobile) Angel Eye (Website) Angel Speedpro (Trading Terminal) |

| SMS Alerts | No | Yes |

| Online Demo | Yes | Yes |

| Online Portfolio | Yes | Yes |

| Margin Trading Funding Available | Yes | Yes |

| Margin Against Shares (Equity Cash) | Yes | Yes |

| Margin Against Shares (Equity F&O) | Yes | Yes |

| Intraday Square-off Time | 3:20 PM | 3:15 PM |

| Other Features | Direct Mutual Funds, APIs for Algo Trading | – |

| Referral Program | Yes | Yes |

Also Read: Click here for Groww’s Brokerage Calculator

Angel One Vs Zerodha – Active Clients and Market Share

| Particulars | Zerodha | Angel One |

| Number of Active Clients | 73,92,836 | 63,02,598 |

| Market Share | 17.67% | 15.07% |

| Complaints | 567 | 1,203 |

Read Also: Top Drone Stocks in India

Zerodha Vs Angel One – Pros and Cons

| Zerodha | Angel One | |

| Pros | 1. India’s No. 2 broker in terms of the number of active clients | 1. Full-service brokerage services are available at ultra-low brokerage fees. 2. Flat fee stockbroker charging INR 20 per order across segments and exchanges. Brokerage-free equity delivery trades. 3. Training and hand-holding are available for beginners. 4. Margin trading facility and securities as collateral are available. 5. Do not charge for NEFT/fund transfers. (Others charge INR 10 per). 6. Only charge INR 20 for intraday square-off and call & trade (others charge INR 50). 7. Free advisory/tips for stocks and mutual funds (Others do not). 8. Local sub-broker/RM services even at a discount brokerage. 9. Facility to call RM if there are issues (Other popular brokers always have busy lines) |

| Cons | 1. It does not provide stock tips, research, and recommendations 2. It does not offer an AMC Free Demat account 3. Call & Trade is charged an extra INR 50 per order 4. It does not offer a 3-in-1 account 5. Auto Square Off is charged at an extra INR 50 per order 6. No margin funding 7. It does not offer monthly unlimited trading plans | 1. Margin funding is given to the customers without notice. This causes major confusion and customers pay hefty interest charges. 2. Angel One doesn’t offer trading in SME shares. 3. Angel RM and the sales team try to cross-sell other products and services. 4. GTC/GTT order facility not available. 5. Doesn’t offer 3-in-1 account. 6. Angel One has limited research and educational resources compared to other brokers. 7. Some users faced disruptions due to past technology issues. 8. Users have had trouble reaching Angel One’s customer service representatives despite their 24/7 support. |

Read Also: Best IPOs that Doubled Investors’ Money

Conclusion

The stock broking industry is booming in India and evolving with new market trends, and new trading and investing platforms. Investors need to look for the right platform and the most efficient one. Our articles help summarize the pros and cons of the stock broking industry. Therefore, choose the platform that aligns with your goals and mindset.

We hope this Zerodha vs Angel One broker comparison has helped you with valuable information. Please let us know your thoughts in the comments below.

Open Your Demat Account with Zerodha, Angel One, 5 Paisa, Upstox, and Groww.